Understanding Shared Branch Credit Unions: How Cooperative Banking Expands Access in 2024

When people think about banking, they often picture large national banks with numerous locations and ATMs. But credit unions, which operate under a different model, offer their members a more community-focused approach to banking. A Shared Branch Credit Union allows members to perform transactions at other participating credit union branches, creating a large, cooperative network that provides expanded access to financial services.

In 2024, this cooperative system will help millions of credit union members nationwide enjoy convenient banking. In this article, we'll explore a Shared Branch Credit Union, how it works, and why it can be a valuable option for people looking for both local service and national convenience. Lets dive right into it!

What Is a Shared Branch Credit Union?

A Shared Branch Credit Union is part of a network of credit unions that have agreed to share their branch locations with one another. This means that even if your credit union only has a few branches in your local area, you can access your account and perform various banking services at any other credit union in the shared branching network.

This system is made possible by cooperation between credit unions, which see themselves as part of a broader community rather than competitors. By pooling their resources, they can offer their members more convenience while still maintaining their core values of personalized service, community involvement, and member-focused benefits.

How Does Credit union shared branching Work?

Credit union shared branching operates through a cooperative agreement where participating credit unions allow members from other credit unions in the network to access their accounts and perform basic banking transactions at their branches. The process is simple and straightforward.

When you visit a shared branch, youll need to provide your credit unions name, your account number, and a valid ID to access your account. Once verified, you can complete a variety of transactions, just as you would at your home credit union. These services typically include:

- Deposits and withdrawals

- Loan payments

- Account inquiries

- Money transfers between accounts

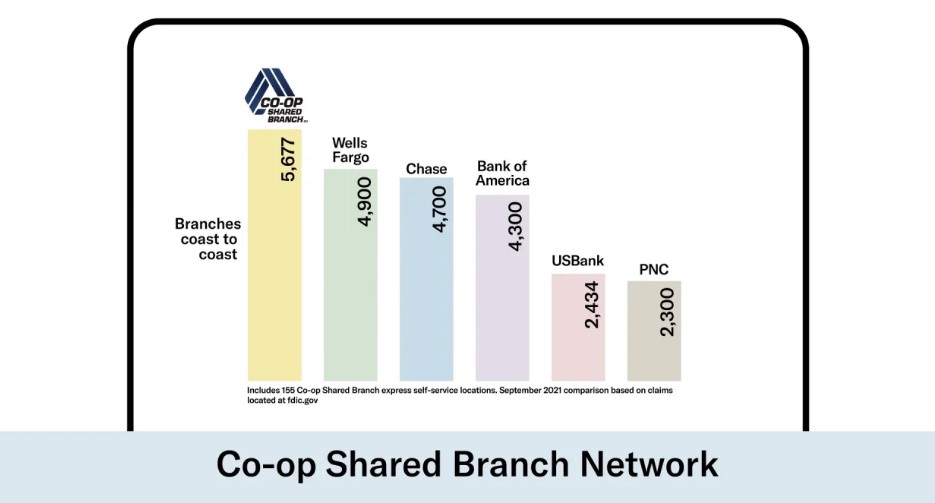

One of the main advantages of credit union shared branching is that it significantly expands the number of locations where you can bank. In the U.S., over 5,000 credit unions are currently participating in the shared branch network, providing access to more than 30,000 branches nationwide. This level of access makes it easy for credit union members to manage their finances anywhere they want.

Benefits of Using a Shared Branch Credit Union

The shared branch network offers a variety of benefits that make it an attractive option for many credit union members. Here are some of the main advantages:

Convenience and Accessibility

One of the biggest challenges credit unions face is their relatively limited number of branches compared to national banks. For members who travel frequently or live in areas without many local branches, this can be a drawback. However, with shared branching, members gain access to thousands of locations across the country, making it easy to find a nearby branch no matter where they are.

This expanded access means that members can rely on something other than online or mobile banking if they prefer in-person service. They can handle important transactions, like depositing checks or discussing loan options, in person at a shared branch.

Personalized Service

Even though youre visiting a branch of a different credit union, youll still experience the same level of personalized service that credit unions are known for. Credit unions pride themselves on treating members like individuals rather than account numbers, and shared branching continues this tradition. The staff at shared branches are trained to assist members from other credit unions with the same care and attention as they would give their own members.

Access to Shared ATM Networks

In addition to shared branches, many credit unions participate in shared ATM networks, such as the CO-OP ATM network. This network provides members with access to thousands of fee-free ATMs nationwide. So, even if you don't need to visit a branch, you can still withdraw cash and check balances, and perform other basic transactions at an ATM without worrying about extra fees.

Potential Limitations of Shared Branching

While Shared Branch Credit Unions offer many benefits, there are a few limitations to keep in mind. These arent deal-breakers for most people, but its important to understand how shared branching works to avoid any surprises.

Not All Services Are Available

While shared branches allow you to handle most of your basic banking needs, some services may not be available at every location. Before visiting a shared branch, its a good idea to call ahead and confirm that they can assist you with your specific transaction. This can help prevent any frustration, especially if you need something more than a standard deposit or withdrawal.

Different Policies Between Credit Unions

Even though the shared branch network operates under a cooperative agreement, each credit union still has its policies and procedures. This means that certain transaction limits, hold times for deposits, or fee structures could vary between your home credit union and the shared branch youre visiting.

Is a Shared Branch Credit Union Right for You?

If youre someone who values the personalized service and community focus of credit unions but needs the convenience of widespread access, a Shared Branch Credit Union is an excellent option. This system combines the best of both worlds: the local, member-focused approach of credit unions with the convenience of a large, national network.

For frequent travelers, students studying away from home, or anyone who prefers in-person banking over digital services, shared branching makes it easier to manage your finances without giving up the benefits that come with credit union membership. Its also a cost-effective way to avoid the high fees often associated with out-of-network ATM withdrawals or using unfamiliar banks.

Conclusion

Shared Branch Credit Unions provide a practical and convenient solution for credit union members who need access to their accounts while on the go. By participating in a nationwide cooperative network, credit unions offer their members thousands of locations where they can handle their banking needswhether depositing funds, making loan payments, or simply checking balances.